You guys already know that I often talk about money on the blog, an example of this is how I publicly publish my blog income reports sharing how much I make each month on this very blog. One of the main reasons I enjoy talking money is because there is so much we can learn from one another.

Let’s jump into some money tips to save and make more money this year.

You guys already know that I often talk about money on the blog, an example of this is how I publicly publish my blog income reports sharing how much I make each month on this very blog. One of the main reasons I enjoy talking money is because there is so much we can learn from one another.

Let’s jump into some money tips to save and make more money this year.

10 Money Tips

This year is going to be a good one. But more often than not, our life is full of too much noise, too much clutter and too many projects that it can be hard to focus. My best advice, pick just one favorite tip and start implementing it. Then, come back for another.

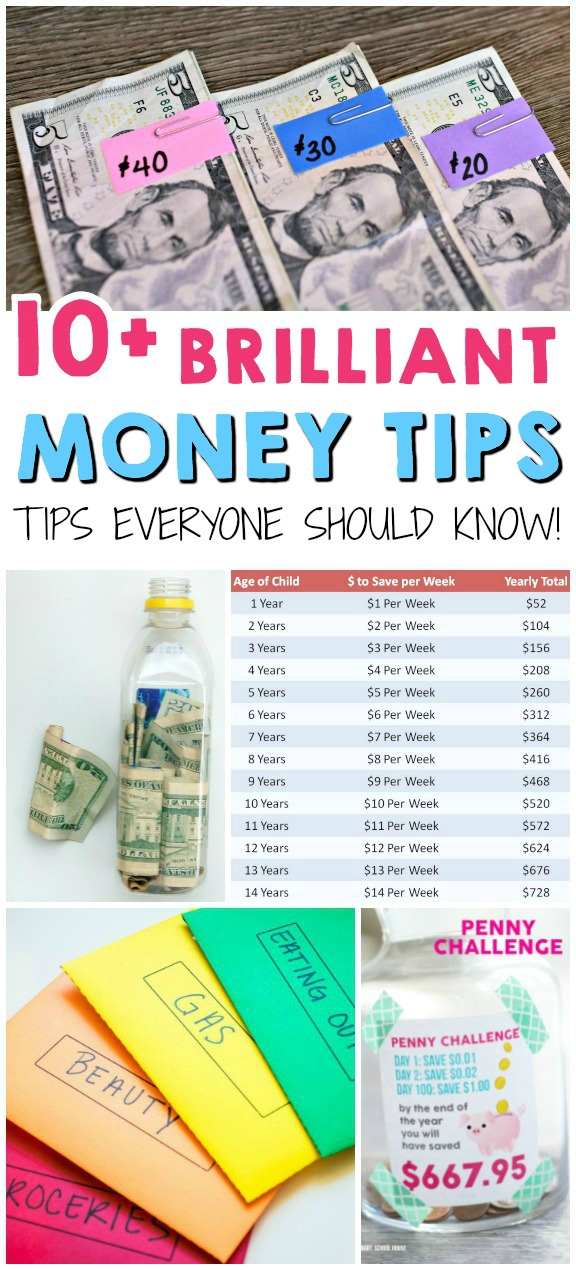

Money Tip #1: The $5 Saving Plan

This one is simple and yet adds up quickly if you are a frequent cash spender. Anytime you get a $5 bill in change, set it aside in a special place. Be ready, it’s going to add up quickly!

Money Tip #2: Make Extra Money Taking Online Surveys

If you have a few minutes here and there and enjoy sharing your opinion, why not take a few Surveys and make some extra side income? It’s free to join and free to take the surveys and you get paid! Here are two companies you can get started with today (both are free to join)…

Money Tip #3: More Ways to Make Money

Sometimes the easiest way to save more money is to make more money. It doesn’t have to be extreme it might just be a small side-hustle for now. Or maybe it’s taking the money that you do have and investing it. Side hustle ideas: Another great option is to talk to other’s more openly about money and hear their ideas. There is so much we can learn from each other and from other generations.Free Workshop: How to Start a Profitable Blog

Looking for extra side income? Here’s how I made over $85,000 working PART-TIME last year… 3 years ago, I started a blog/website to test if a stay-at-home mom could make money online “blogging”. I put blogging in quotes because blogging is totally different than what I used to think of it. The awesome part about this particular side business (besides the fact it makes over full-time income with part-time hours) is that you’re creating PASSIVE income and can be done from ANYWHERE. Last year we made over $85,000 by blogging part-time. Not to mention, I took 3 months of “maternity leave” at the beginning of the year and we traveled a large portion of the year as well! I’m hosting a (free) online webinar all about how to start a blogging side business (no tech knowledge required)! >> Click here to register. << You’ll have the chance to start blog during the online workshop (start one as you follow along with my demonstration) – I’ll walk you through everything step-by-step!

Money Tip #4: Meal Plan Tip

Did you know the typical American wastes between 30-40% of their food each week? If someone is spending $100 a week on groceries, $30-$40 of that is spent on items that will be trashed. Imagine if someone bought 10 bags of groceries and then on their way out of the store tossed 3 bags in the garbage. The best solution is meal planning. We all know that meal planning saves us tons of money but yet week after week we avoid it. Or at least I was. Until I finally figured out a trick to make meal planning take less than 10 minutes. Before I was sitting down each week with a blank sheet of paper trying to rack my brain for my favorite easy recipes and if I got stuck I’d open up Pinterest and ask those around me for ideas. It was time-consuming and I’d get frustrated if the ideas I found required way too much time in the kitchen. Then one day I remembered a meal we loved, one that I used to make all the time that I’d forgotten about. That’s when I realized making a meal plan from scratch every week was a waste of time. I started keeping my previous week’s meal plans as templates. That way I could scan over them, and quickly remember all our favorite meals and quickly create a fresh meal plan for the coming week. The first couple of weeks will obviously take longer as you’re creating your initial lists of meals but after that, you’ll be recycling your lists and borrowing meal ideas. Some weeks I borrow 4 meal ideas from various lists, add 2 new ones and go from there. Other weeks I borrow an entire meal plan exactly as is. Extra tip: Always make double and freeze the extra for another day! (This white chicken chili recipe, for example, is a great one to double and freeze.)

Money Tip #5: The Spending Cheat Sheet

This one sounds a little nitty-gritty but this cheat sheet makes it super easy. If you haven’t ever taken a close look at where your money is going, this step is going to help you figure out exactly where your money is going.- Click here to download the free cheat sheet. You may need to print multiple worksheets to fit all your expenses.

- Pull out all of last month’s bank/credit card statements.

- Write down every single thing you spent money on and put the total spent in the category it best belongs in.

- The final step is evaluating and making a commitment. You’re probably already seeing some places that you can cut your spending. Your task is to look through the list and make a commitment for the upcoming month. Here are some examples:

- Save on coffee – if you spent $50 on coffee last month, commit to spending only $25 this month.

- Save on gas – find someone to commute to work with 2 days a week.

- Unsubscribe from a monthly subscription – like a $7 premium commercial-free music app. Can you live without it for a month or two?

- Save on groceries – eat as much food as possible out of the pantry and freezer instead

- Save on clothing – go on a 2 week fast from buying new clothing

Money Tip #6: The Cash Envelope System

While this isn’t a new method by any means, it is very effective and therefore worth listing here. Step #1: You need to figure out your list of expenses (you can use our spending worksheet to quickly figure out how much you are typically spending in each category). Then decide how often you want to fill your envelope. Click here to see complete instructions and download the envelope templates.

Money Tip #7: The Penny Challenge

Begin any day of the year, collect pennies, and after 365 days you will have saved almost $700! Click here for the cute printable.Money Tip #8: The Painless Vacation Fund

This is an absolute genius way to save over $1200 a year without even noticing. Use the funds for a vacation or whatever you’re saving up for. Step #1: It’s so simple. Request $20 cash back every time you go to the grocery store and your fund will add up fast. Click here for complete directions on making this fund a success.

Money Tip #9: Save $10,000 by Your Child’s 18th Birthday

This is an easy, totally doable system. And you can easily double {or even triple!} the savings amount by getting the grandparents in on it too. Step #1: Each week, save the amount of money your child is old. Example: My daughter is 3 years old. Each week I deposit $3 into her account. Click here for complete directions on making this fund a success.

Money Tip #10: Pay Off Your Mortgage Early

One of the easiest, most painless tips I’ve ever heard is to pay 1/4 of your mortgage weekly instead of paying monthly. Since every month is actually a little bit more than 4 weeks by the end of the year, you’ll end up paying in extra without even noticing it. The reason for this is simple math, there are 52 weeks in a year, divided by 4 weeks (every 4 weeks is a full payment) equals 13 full payments instead of the typical 12 if you were paying monthly. Every year making an extra payment adds up quickly. Depending on the size and length of your loan, you’ll most likely pay off your house years earlier and save thousands on interest you otherwise would have paid. Want to take it one step further, round up each mortgage that you pay. This only works if you’re mailing in a check (and not on auto-pay). If your mortgage is $787 round it up to $800 every month. You’ll barely notice the extra dollars missing that month while your mortgage will in the long run.You Got This!

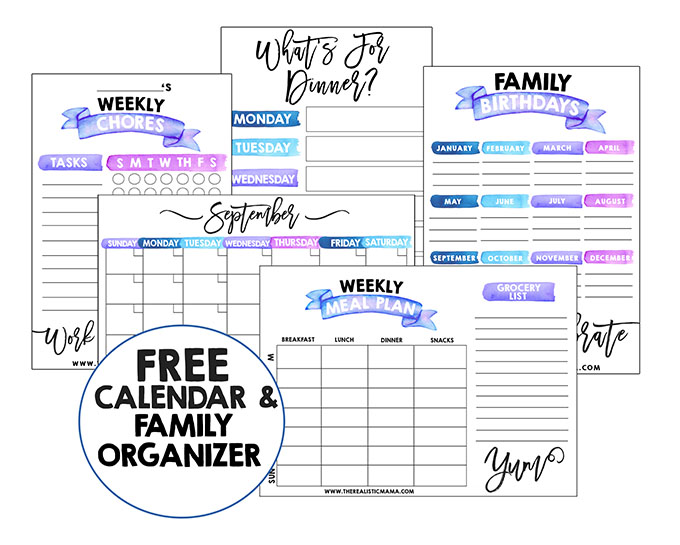

Remember, just pick one favorite tip and start implementing it. Then, come back for another. Join our newsletter for more great tips to simplify your life.P.S. Are you looking for extra side income? I make full-time income blogging part-time—check out this easy step-by-step tutorial on how start a blog (no tech knowledge required).Download My Free Family Organizer

Ready to de-stress + spend more time with your kids?

Life gets busy. I hear you. I'm here to show you how to CREATE more time for what matters most. Get a free family organizer as a thank you for joining our newsletter – includes monthly calendars, chore charts, meal planners and more...

I love your ideas, especially putting cash in a water bottle where you can’t easily get to it (a challenge for me!) and saving according to your child’s age. I am expecting my first grandchild in November and I am going to send this top to each of the grandparent families and suggest we all do this to start a college fund for our new grandchild. Since each of the grandparents is divorced and remarried, there are four grandparent families. If we all participate, the baby will have almost $43,000 by the time he or she graduates from high school to put towards college. That’s amazing! And since the contributions are so small, it’s easy to do without feeling the pinch. Thank you for these great suggestions!

Wow that is a great idea! You are so right, if you each contribute a little bit it will end up being a great amount of without anyone feeling the “pinch”. I am so glad that you found these tips helpful!

I am 64 yrs old. I talk openly with two of my older children. Do not talk money with my friends though. I’m the CFO and find it somewhat awkward or uncomfortable when I need to talk to my husband about our finances.

Something I do to save money for my little one… Every $1 or .50¢ piece I come across I put into her piggy bank. Granted I work at a gas station so I come across these often. I have also bought them off of tellers at the bank. I don’t hardly notice the money is gone yet it’s still here.

Great idea!

I love the $5 savings plan! I started doing it when my husband(then my fiancé) and I bought our house. I saved the money for a purse I wanted. After achieving that goal in April, started saving for our souvenir money for our honeymoon which was in June. Then we went on a quick trip to the beach in August, took my $5 bills with me as spending money and ended up not spending all of it, so now we are using it as our Christmas fund for each other. Such an easy way to save money without even noticing it’s gone. Once we start our family I can’t wait to try to save weekly for our child’s future. My parent’s didn’t have a college fund for me, but I want to be able to give my children one, even if it is enough to pay for community college.

I love this! Keep it up!

Unless you get Paid weekly it is most often not a good idea to pay your mortgage weekly. Yes you pay it faster but it can also cost you more. If you don’t have cash that day you have to use credit to pay. You can just as easily increase your payments and put it on your pay day. If you get paid on the 15th and 30th it makes sense to make your bills come out on the those days. Don’t forget that if the earning potential of your money is higher then the interest on the mortgage. It would makes sense to hold on to that money as long as you can to earn as much as you can before you pay your mortgage so monthly payments may make more sense depending on the person. For example a business owner may need that money to reinvest in his company to make higher profits on there next pay day. One last thing if you want to save money on mortgage. Some places if you have a home based business you can wright off part of your interest on your mortgage to reduce your tax look up tax regulations in your area. Reducing you taxable income can help you save 100s of dollars more every year. Get informed get active in every aspect of your money and it can go far.

Most mortgage companies do not allow weekly payments. They put it towards principle and not to your monthly note/payment, which can make you behind. Crazy, I know this from experience. You can call and ask if they have a bi-weekly payment plan that will automatically withdraw half your monthly note every pay period, including 2 extra pay periods you get a year. Takes 7+years off of mortgage.

Good to know! Thank you!!