Want to know an easy trick to save over $10,000 for your child by the time they are 18? It’s an easy, totally doable system! And you could easily double {or even triple!} that amount by getting the grandparents in on it too!

Saving is something I really have to work at. I am spender by nature. I see it, I want, I buy it. So savings is something we plan for, and have to work at. I have 2 girls, and I wanted to make sure I can give them the things I always dreamed of giving them, but I want to make sure I can do it without going into debt.

When I got married, I loved what my parents did for me, they handed me a prepaid card, with a set amount of money on it, and said here is the money we set aside for your wedding. They gave me NO conditions with it. They said, “You can elope, you can spend half on wedding half on honey, you can put all of it on a down payment to a house, it’s your money, but when it runs out, that’s it. So budget your wedding carefully.”

Looking back there are so many things I wish I had done differently with that money, but I had a beautiful wedding, and our honeymoon has been a trip with memories that have lasted 6 years! We still talk about the fun we had! So all of that said, I wanted to do the same for my girls. I wanted to give them the opportunity to plan and budget and spend freely with the money I set aside.

It seems like between, college, extracurricular activities, and marriage there is an overwhelming amount of things to save for! But we have college fund (I should look at putting more into) and we now have this marriage fund. You can use this fund for whatever- a car, college, moving expenses, a senior trip, just give them the money, invest it for them, help with a down payment on a house. Whatever you decide here is 1 Easy Way to Save for Your Child’s Future. The possibilities are endless!

Here is how we are saving, $10,692 for our child by the time they are 18 with 1 Birthday gift a year and never spending more than $18 a week.

How to Save Money for Kids

It’s this simple: Each week, save the amount of money they are old. On their birthday deposit an additional $100 as a birthday gift.

Example: My daughter is 4years old. Each week I deposit $4 into her account.

Small amounts add up! They do make a difference! If you can double it! If not that’s ok! Here is the breakdown by age of what you will save with just depositing the dollar per age amounts:

1 Year $52

2 Years $104

3 Years $156

4 Years $208

5 Years $260

6 Years $312

7 Years $364

8 Years $416

9 Years $468

10 Years $520

11 Years $572

12 Years $624

13 Years $676

14 Years $728

15 Years $780

16 Years $832

17 Years $884

18 Years $936

That alone totals $8892.00! And you never spent more than $18 a week!

If you add $100 at each birthday over 18 years that’s $1800.00

Put those together you have $10,692.00 by their 19th birthday. This can easily be doubled, or you can more as you have more money. But we found this a great start for us. I wasn’t sacrificing anyting with this plan. $18 a week was simply not buying an extra box of hoho’s at the store, and not eating out 3 times a week. We chose to use the money that we would have used to order a pizza, and make it at home instead. We didn’t have to sacrifice to save. None of this includes interest, or investing the money! Research and figure out what will best work for you, maybe a long term CD, or a savings account with interest.

The possibilities are endless with this method. Maybe a grandparent will match the birthday gift portion every year? Once the child turns old enough to teach about money you tell them they have a savings account and start teaching them to save a portion of their allowance. Instead of spending your extra change on soda, run through the bank and deposit it. The key is LITTLE AMOUNTS ADD UP OVER TIME!

Found an easy way for your family to save money? Share it with us!

Before you go… are you following us on Facebook and Pinterest yet?

Visit Alida | The Realistic Mama’s profile on Pinterest.

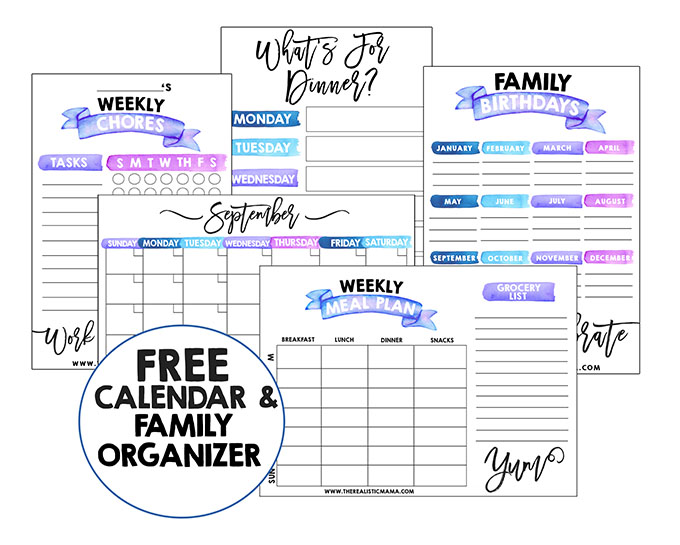

P.S. Are you looking for extra side income? I make full-time income blogging part-time—check out this easy step-by-step tutorial on how start a blog (no tech knowledge required).Download My Free Family Organizer

Ready to de-stress + spend more time with your kids?

Life gets busy. I hear you. I'm here to show you how to CREATE more time for what matters most. Get a free family organizer as a thank you for joining our newsletter – includes monthly calendars, chore charts, meal planners and more...

I love this idea!

Do you start the week they’re born or after their first birthday?

Great question! The simplest way is to start at their first birthday, reaching the grand total by their 19th birthday.