*I’m giddy!* I found the best money saving app and it’s FREE. I’ve been testing it out for the last couple months and love it. It helps you automatically save money by analyzing your spending history in your checking account and saving small bits of money here and there that you won’t miss. I’ve been telling all my friends about it and now it’s time for you, my friend, to enjoy its benefits too!

Update: The app in no longer free. They give you a 100 day free trial and then it’s $2.99 a month. We’ve currently stopped using this app but it’s still a great tool if you have trouble saving.

This post may contain affiliate links. Please read my disclosure for more info.

This post may contain affiliate links. Please read my disclosure for more info.

Best Money Saving App

When I first heard about the Digit app I spent hours researching it and found only good things. It’s an online bank savings account (FDIC insured and everything) that syncs with your current bank account making small savings transfers here and there.

What’s cool is it tracks your income and spending habits and sets aside small amounts of money – a few bucks here and a few bucks there that you otherwise would have spent without realizing it.

Why I love it:

- You set it up, then it runs on its own.

- It’s simple and it works.

Right now I’m saving for our next traveling adventure ($251.94 saved up so far!).

What Other’s Are Saying:

To give you additional perspective, I texted two friends to see if they would be willing to share how Digit is working for them:

I love it because it’s easy and works in the background and I don’t have to think about it. It’s just an extra little savings off to the side! Our plan is to use the Digit savings on house projects this summer! And we won’t have to take money from our regular savings to do that. ☺#yayus

— Maggie B.

It’s always fun to see how much money Digit has saved for me that I might otherwise have blown on stuff that I didn’t need. Makes it really easy to save money.

— Hali H.

Get Started with Digit:

- Sign up (it’s free).

- Connect your current bank account to Digit.

- Digit will start watching your spending habits and transfer small chunks ($1.74 here, $7 there, etc.) from your regular checking account into your new Digit savings account. The savings are automated and smart, so you don’t have to worry about overdraft.

All funds held within Digit are FDIC insured up to a balance of $250,000. You keep complete control of your money – turn off automatic transfers at any time and transfer money back and forth whenever you like.

Try Digit now, then check back in a few weeks and leave a comment with how much you’ve saved!

Choose the Next Post You Want to Explore:

Share on Facebook:

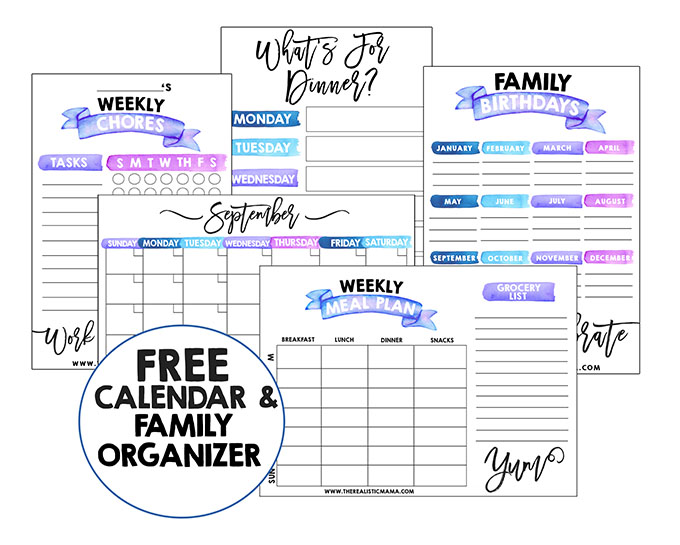

P.S. Are you looking for extra side income? I make full-time income blogging part-time—check out this easy step-by-step tutorial on how start a blog (no tech knowledge required).Download My Free Family Organizer

Ready to de-stress + spend more time with your kids?

Life gets busy. I hear you. I'm here to show you how to CREATE more time for what matters most. Get a free family organizer as a thank you for joining our newsletter – includes monthly calendars, chore charts, meal planners and more...

Leave a Reply